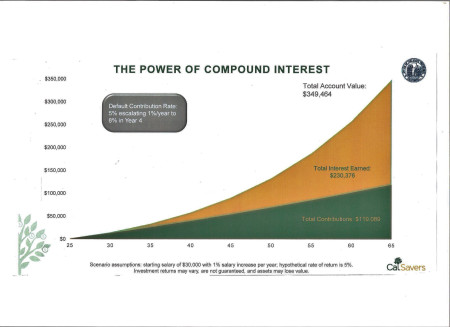

CalSavers chart shows potential retirement savings over 40 years

November 5, 2018 - Calpensions

Itfs been a while since the state rolled out a new mult-billion program that could touch the lives of 7.5 million Californians, not to mention one intended to be self-supporting with no money from taxpayers.

But now CalSavers is scheduled to launch a pilot Nov. 19 for an on-the-job retirement savings plan, formerly known as Secure Choice, that will be open to all eligible employers next July.

Itfs facing opposition from a coalition of business groups and a taxpayers suit to shut it down.

Employers with five or more employees, who do not offer a retirement plan, will be required by state law to offer the CalSavers plan to their employees in three waves based on employer size. Employees can opt out.

After the pilot and the voluntary period beginning next July 1, employers with 100 or more employees must register with CalSavers by June 30, 2020, employers with 50 to 99 employees by June 30, 2021, and employers with 5 or more employees by June 30, 2022.

What some call an gautomatic IRAh payroll deduction is said to be a proven way to increase retirement savings. Nearly half of California workers are projected to retire into economic hardship at or below 200 percent of the poverty level, a UC Berkeley report said.

gCalSavers will finally level the playing field for millions of hardworking Californians who donft have access to a retirement program at work,h Katie Selenski, CalSavers executive director, said last week. gTheyfll have a simple, portable way to save for their futures with low-fee, professionally managed investments, and itfll be easy for employers to facilitate.h

For employees who do not opt out, the standard contribution to CalSavers starts at 5 percent of pay and increases 1 percent of pay each year until reaching 8 percent. Employees can change contribution rates, pause contributions, and opt out and return later.

If the employee doesnft make a different choice, the first $1,000 in contributions goes into a low-risk money market fund. Then contributions go into a target date fund that shifts to more conservative and less risky investments as the employee nears retirement age.

Employees also can choose among other mutual funds also managed by State Street: A high-quality bonds fund and a fund combining domestic and international stocks.

Contributions go into Roth IRAs, unless the employee chooses a traditional IRA. The pilot is expected to start with about 20 diverse employers and grow to 50 or more. The first contributions are expected to start flowing in January.

The total CalSavers administrative and investment fee, now 0.82 to 0.92 percent of assets depending on the investments chosen, will drop significantly as the fund grows. The total fee, capped at 1 percent after six years, will repay a state start-up loan of $3 million so far.

To avoid state costs, the initial $1 million for a feasibility and market study was paid for by donations. The Laura and John Arnold Foundation, often vilified by unions for supporting public pension reform, contributed a $500,000 matching grant.

Two large public employee unions, the California Teachers and the SEIU, each contributed $100,000. Public employee unions played a major role in a national drive to create state-run savings plans for the private sector. (See report here)

Public unions think improving private-sector retirement can help counter pressure to cut government pensions or, following the corporate trend, switch to 401(k)-style individual investment plans that create no long-term debt for employers.

The nine-member CalSavers board has looked at a public union-backed gpooled IRAh that could gradually, by diverting some of the investment yield in good years, build a reserve large enough to replace some of the losses in a bad year.

Under the CalSavers authorizing legislation, SB 1234 in 2016 by state Sen. Kevin de Leon, D-Los Angeles, employers have no liability and the state does not guarantee the CalSavers fund.

CalSavers chart shows potential retirement savings over 40 years

A federal judge hearing the Howard Jarvis Taxpayers Association request for an injunction halting CalSavers, and a ruling that CalSavers is invalid under federal law, directed both sides in the case to file supplemental briefs by Nov. 15.

The key issue is whether CalSavers is exempt from the federal Employee Retirement Income Security Act of 1974 (ERISA). An exemption is required by the CalSavers authorizing legislation to avoid exposing employers to liability and burdensome federal regulations.

De Leon and state Treasurer John Chiang, who has provided an office and staff aid for CalSavers, joined officials from other states in successfully urging the Obama administration to provide a gsafe harborh labor regulation exempting state opt-out savings plans from ERISA.

After President Trump took office last year, the Republican-controlled Congress, through the rarely used Congressional Review Act, passed fast-track legislation signed by the new president that repealed the 2016 safe harbor regulation.

A big issue now is whether mandatory state opt-out savings plans are exempt from ERISA under an earlier regulation. The supplemental briefs ordered by U.S. District Judge Morrison England are for interpretations of the 1975 safe harborfs gcompletely voluntaryh requirement.

Gov. Brown sent a letter to the California congressional delegation last year urging opposition to the legislation repealing the 2016 safe harbor regulation. He said CalSavers aims to enroll workers who historically have not been served by the savings industry.

gI understand that Wall Street institutions strongly object to California and other states setting up such systems,h Brown said. gThey think the dollars that move into Secure Choice (now CalSavers) should instead flow into their own products.h

As the suit to block CalSavers was filed in May, Jon Coupal, president of the Jarvis taxpayers group, said there is no need for the program and pointed to the large debt or unfunded liability of two state pension systems.

gPrivate employees already have access to Social Security which is backed by the full faith and credit of the federal government. Moreover, individual retirement accounts (IRAs) are easy to set up,h Coupal said.

gGiven the poor performance of CalPERS and CalSTRS, both in terms of investment performance and governance, why would we give state politicians and bureaucrats access to another pension program?h

A coalition of 30 business groups led by the California Chamber of Commerce urged the state Office of Administrative Law to reject CalSaver regulations submitted on Oct. 24.

The business coalition said the CalSaver regulations do not meet the 1975 safe harborfs requirement that automatic enrollment be gcompletely voluntaryh to be exempt from ERISA.

gThis (CalSavers) automatic enrollment is not ecompletely voluntaryf,h said the letter signed by Marti Fisher, a Chamber lobbyist. gOnly the opportunity to opt out is voluntary.h

A spokeswoman said Fisher will revise her comments based on an edited version of the regulations expected to be approved by the CalSavers board this week and refiled with the Office of Administrative law on Nov. 8.

Upon filing, a five-day public comment period and a 10-day Office of Administrative Law review period begin simultaneously. If the regulations are approved, they would take effect on Nov. 19.

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at Calpensions.com. Posted 5 Nov 18